With the presidential election just a few weeks away, you can expect to be inundated with predictions about how the winner will affect markets and the economy.

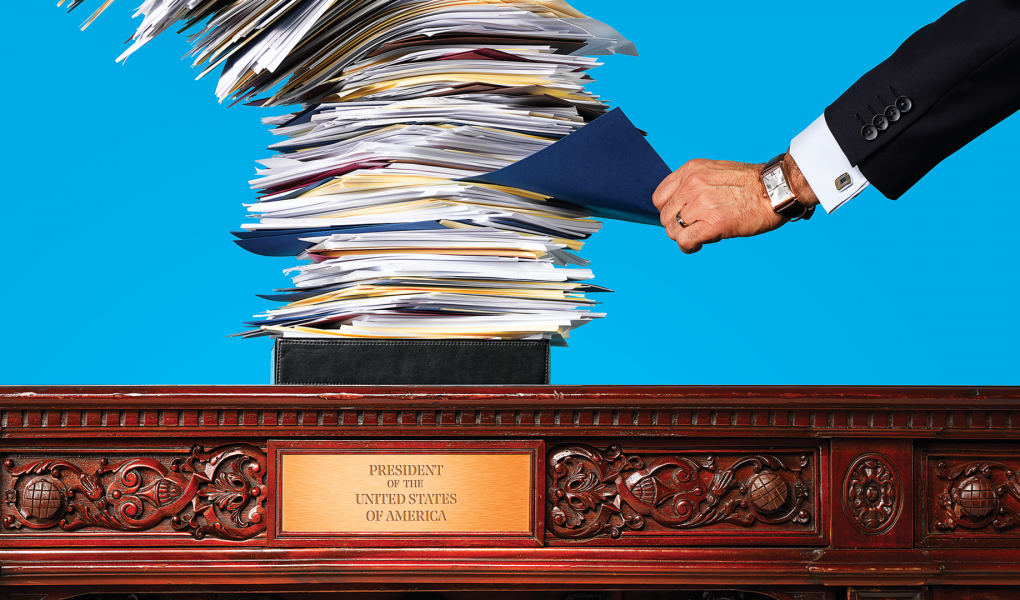

It can be entertaining to guess how the outcome of the elections will affect your wealth, but this becomes a futile exercise once you realize how much we don’t know about what will come next. Not only do we not know who is going to win but also:

We do not know what policies they will implement while they are in office. We do not know how receptive the other party will be to those policies. We don’t know how the person in charge will affect spending and consumer confidence in the economy. We do not know which sectors or industries will be the biggest winners and losers. We do not know how investors will react or what they have already calculated about the outcome of the elections.

When Trump was elected, there were a host of experts and investors who predicted a huge market crash.

When Obama was elected, there were people who predicted: “[His] radicalism is killing the Dow.” Instead, stocks started in 2009 in a bull market that lasted the entirety of the next decade. There were nearly 130 new all-time highs in the S&P 500 during Obama’s term.

Additionally, much of the performance in the stock market under any management depends on where we are in the cycle when they take office. Bill Clinton and Ronald Reagan took office at opportune moments during one of the largest bull markets in history. On the other hand, Franklin D. Roosevelt’s time in office was underpinned by the Great Depression and World War II, while George W. Bush came to power just before September 11 and ended his term during the Great Financial Crisis. . . . .

Regardless of who wins next month, it’s important to keep the policy out of your portfolio. Financial decisions are already riddled with emotions, prejudices, and blind spots. Bringing politics into this equation only amplifies those emotions and makes it nearly impossible to make rational decisions with a clear head.

If you are thinking of selling all of your shares based on the winner of the presidential election, be sure to ask yourself the following questions first:

If I sell the market to the president, does that mean I have to stay out of the market until a new president takes office?

If I sell the market because of the president and the stock market goes up, will I buy again or will I stay on the sidelines?

If I sell the market because of the president and the stock market crashes, will I buy at lower prices or will I continue to sit based on my political beliefs?

If I sell the market because of the president and things are not as bad as I originally thought, how will I know I was wrong?

There are never easy answers when it comes to hurting markets, because no one knows what the future holds.

There are only two things that I am sure of when it comes to mixing politics with investment decisions: (1) The stock market will rise and fall no matter who the president is, and (2) You will invest your money based on how vote. November will not result in sound financial decisions.