A contested election that could lead to a full-blown constitutional crisis. A third wave of COVID. A rescue stimulus package has stalled in Washington.

As the calendar shifted to October, the beginning of the final quarter of 2020, these clouds hung thick and dark over the markets. Veteran investors could be excused for wanting to take the fourth quarter off, a common strategy in a presidential election year.

But something unusual happened. In keeping with this completely unpredictable year, the markets rallied, with the Nasdaq and S&P 500 rising 2.2% in the first week of October, enough to recoup almost all of September’s losses.

What gives?

You can call it an early October surprise that can have a lasting impact for the next four years and beyond.

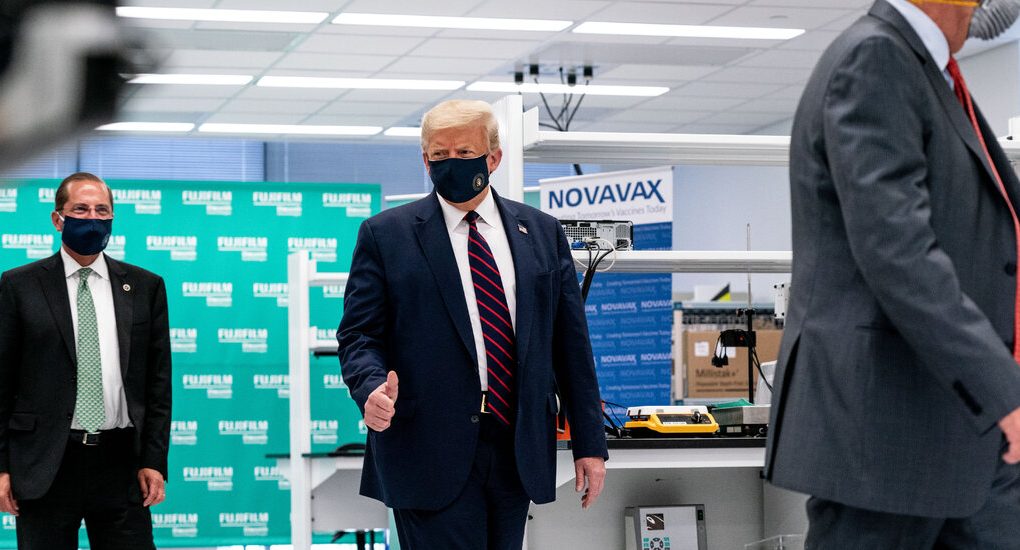

President Trump’s positive COVID-19 diagnosis may have caused confusion in his re-election bid, but it has had the opposite effect on markets. From that point on, Joe Biden’s leadership in the polls and the electoral odds solidified, and Wall Street and investors began to understand how their portfolios would work with a Democrat in the White House and a blue coup. to Congress.

Wall Street generally hates one-party control. And if anything, he generally prefers a low-tax, regulation-breaking Republican in the Oval Office. That anxiety runs deep, even if the historical data doesn’t support the paranoia.

But this year, the script has changed. Wall Street is not only unfazed by the prospect of Washington bathing in blue in January, it sees upside potential.

Yes, a Biden presidency would likely mean a tax increase sometime after 2021, but overall, the pros outweigh the cons, says a growing chorus of Wall Street analysts.

“A blue wave would probably push us to improve our outlook,” Goldman’s chief economist Jan Hatzius told investors last week followed by longer-term increases in spending on infrastructure, weather, healthcare. and education less closely matched by likely long-term tax increases on corporations and higher-income individuals. “

Jeff Buchbinder echoes that message of not being afraid. Buchbinder, vice president and market strategist at LPL Financial Research, sees the addition of a large stimulus spending package from a Biden-led White House plus the elimination of the Trump-era trade wars as two tailwinds for American businesses. . . . that could almost offset the negative impact of a Democrat-led rate hike.

Still, Buchbinder estimates that the 10% impact (Goldman calculates it with a 9% impact) on corporate profits that you would see with a Biden tax increase matches the EPS increase you would get from eliminating tariffs on major US trading partners in China and Europe. . .

And, it should be noted, the consensus is that a Biden tax increase would be diluted before it is enacted into law.

Still, it’s time to analyze which sectors would be most exposed to Biden’s tax proposal. As with any new tax plan, there will be winners and losers.

According to Goldman Sachs, the following sectors – information technology, healthcare, communications services, and consumer discretionary – could see the biggest EPS impacts from a tax rate increase in the coming years. Energy and finance would be less exposed, as the following chart from Goldman shows

On September 2, the S&P 500 plunged to 3,281.06, putting it within a few fractions of a percent of breakeven for 2020. After the markets closed that day, my inbox was filled with all kinds of analysis. . . Historical accounts of how Wall Street typically underperforms every four years in the two months leading up to a presidential election. The message was clear: History says we must switch to cash and wait until the United States elects a president.

As it is now, that would have been an extraordinarily bad move. The S&P 500 has risen 6.5% since then (as of October 8 close) and market volatility, as measured by the VIX index, is flashing green.

But, dear reader, we are still in October. There is no rule that says only one October surprise per election cycle. Anything can happen between now and Election Day.